Services

Martin G. Friedrich, CPA has over 25 years of experience in individual and business taxation, with an emphasis in real estate. Our firm primarily performs tax, accounting, and consulting services for small businesses, real estate companies, and complex individual taxpayers.

Individual Tax Services

- Federal tax return preparation

- Multi state tax return preparation

- Estimated tax calculations

- Sole proprietor tax forms and consulting

- Incentive stock option tax calculations

- 1031 Exchange calculations

- K-1 partnership processing and explanation

- Low Income Housing Tax Credit processing

- Amended returns

- Tax audit representation

Real Estate Tax Services

- Rental property tax forms

- Basis and Depreciation tracking

- Gain and tax on sale of property calculations

- California form 593 consulting

- Installment Sale tax calculations

- 1031 Exchange calculations

- REIT contributions

- Tenant in common consulting (TICs)

- Real Estate Professional election consulting and preparation

Partnership and LLC Services

- Federal Partnership tax return preparation

- Multi state tax return preparation

- Non resident tax withholding calculations and forms

- Structuring of entity consulting

- Formation and dissolution form filing for California

- Single Member LLC consulting

- Property contributions and distributions consulting

- LLC agreement tax provision and accounting review

- Developer tax issue consulting

- Compensatory partnership interest consulting and Sec 83(b) elections

- Section 743 Basis calculations

- Family limited partnerships

Estate and Trust Services

- Form 1041 Trust and Estate Income Tax Returns

- Subtrust Funding consulting

- Trust Accounting

About Us

Since 1984, our firm has been providing quality, personalized service to local small businesses, individuals, real estate owners and investors, developers, and contractors.

Brendan G. Friedrich, CPA

Brendan is a licensed tax professional with 10 years of experience in public accounting. He graduated with a degree in Economics from UC Berkeley and practiced tax as an Enrolled Agent for 4 years prior to obtaining the CPA designation in 2018.

His experience primarily includes preparing business and complex individual tax returns, as well as tax projections and analysis. In addition, Brendan consults with clients on general tax issues and advises them regarding potential tax-planning opportunities.

Kyle Friedrich - Accounting Assistant

Kyle has worked for Martin Friedrich CPA since 2009. His primary duties have been the preparation of individual income tax returns, Form 1099 and 1096, as well as some client accounting. His software program experience includes Lacerte, Quickbooks, Peachtree, Microsoft Excel, and Microsoft Word. Kyle is currently attending Foothill College where he is studying to become an Enrolled Agent.

Martin G. Friedrich, CPA

Martin G. Friedrich, CPA has been in practice over 30 years. Now retired. Mr. Friedrich started his firm in 1984 and has been providing tax services to individuals, partnerships, trusts, and corporations. His practice emphasis is in real estate, partnerships and Limited Liability Companies. Prior to opening his own practice, he was with Arthur Young and Co in San Francisco for over 3 years as an auditor and a computer audit specialist.

Mr. Friedrich graduated magna cum laude in Business at UC Berkeley, receiving the Peat Marwick Mitchell distinguished student award. He completed coursework required for a Master in Taxation at Cal State Hayward. His continuing education has included advanced seminars in real estate and partnerships. Mr. Friedrich is a member of the California Society of CPA’s and has served on the continuing education Real Estate Tax committee.

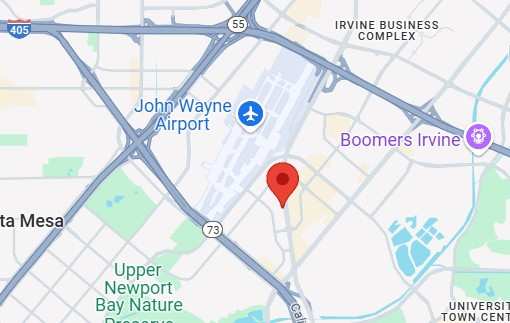

Contact Us

We welcome any questions or comments you may have. Let's discuss your situation so that we may understand your objectives and determine how we can add value.

Call (949) 553-1040